What Does Bank Code Mean?

Wiki Article

7 Simple Techniques For Bank Account Number

Table of ContentsSome Of Bank CertificateExcitement About BankThe 20-Second Trick For BankingNot known Facts About Bank Code

You can also save your cash and earn interest on your investment. The cash stored in most bank accounts is federally guaranteed by the Federal Deposit Insurance Firm (FDIC), approximately a limit of $250,000 for individual depositors and also $500,000 for jointly held deposits. Banks likewise offer credit possibilities for individuals as well as companies.

Banks earn a profit by billing even more interest to borrowers than they pay on interest-bearing accounts. A bank's dimension is established by where it is situated and that it servesfrom tiny, community-based establishments to big industrial financial institutions. According to the FDIC, there were simply over 4,200 FDIC-insured industrial banks in the USA since 2021.

Standard financial institutions use both a brick-and-mortar area and also an on the internet existence, a brand-new trend in online-only banks emerged in the early 2010s. These financial institutions usually supply consumers greater rate of interest and also lower fees. Ease, passion rates, and also costs are several of the factors that aid consumers determine their chosen financial institutions.

The Definitive Guide for Bank Certificate

banks came under extreme scrutiny after the international monetary dilemma of 2008. The regulative environment for banks has actually because tightened substantially consequently. United state banks are controlled at a state or national degree. Depending on the framework, they might be controlled at both degrees. State banks are managed by a state's division of banking or department of economic organizations.

You need to consider whether you intend to maintain both service and individual accounts at the exact same financial institution, or whether you want them at different banks. A retail financial institution, which has basic banking services for consumers, is one of the most appropriate for everyday financial. You can select a typical financial institution, which has a physical structure, or an online bank if you do not want or require to physically check out a financial institution branch.

A neighborhood financial institution, for instance, takes deposits as well as offers in your area, which could supply a more tailored banking partnership. Pick a convenient location if look at this site you are selecting a bank with a brick-and-mortar area. If you have an economic emergency, you don't wish to need to take a trip a far away to obtain cash.

The Single Strategy To Use For Bank Reconciliation

Some banks likewise offer smartphone applications, which can be valuable. Examine the costs related to the accounts you wish to open. Banks bill rate of interest on fundings in addition to monthly upkeep costs, overdraft account charges, and also wire transfer fees. Some large financial institutions are relocating to finish overdraft account fees in 2022, to make sure that could be an essential consideration.Financing & Growth, March 2012, Vol (bank statement). 49, No. 1 Institutions that match up savers and consumers aid guarantee that economic situations work efficiently YOU have actually obtained $1,000 you don't need for, say, a year and intend to make income from the money up until after that. Or you intend to get a house as well as need to obtain $100,000 and pay it back over 30 years.

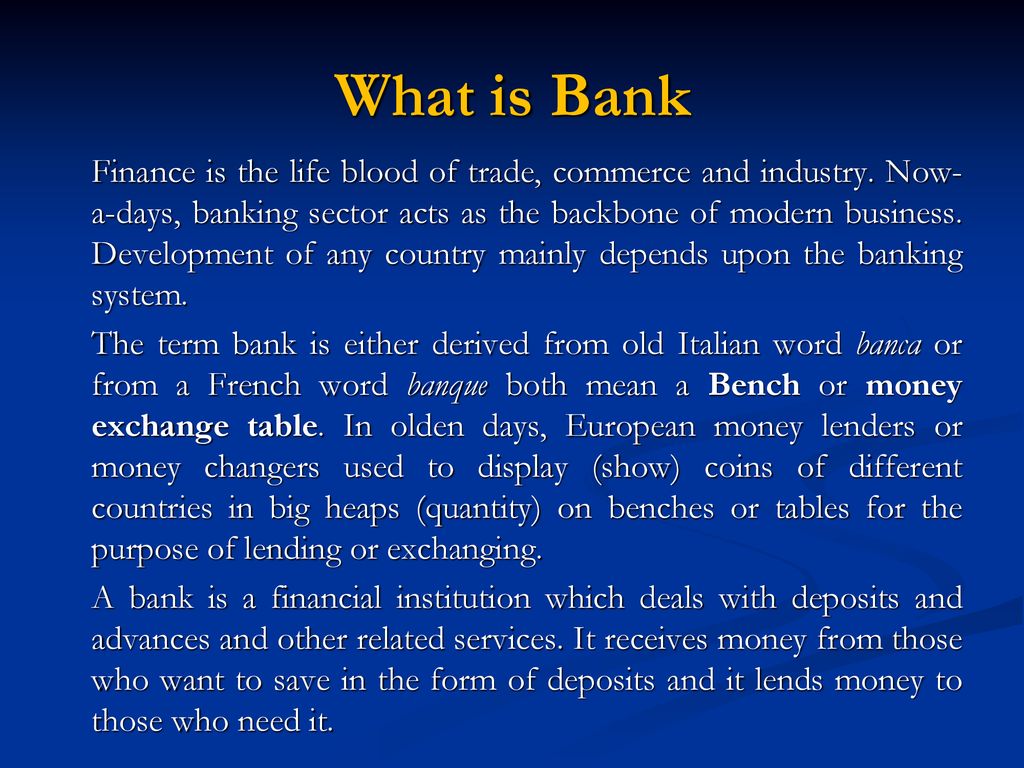

That's where banks can be found in. Although banks do numerous things, their primary role is to take in fundscalled depositsfrom those with cash, pool them, as well as offer them to those that require funds. Financial institutions are intermediaries between depositors (that provide cash to the bank) as well as consumers (to whom the bank provides cash).

Down payments can be offered on need (a monitoring account, for instance) official statement or with some constraints (such as savings and also time deposits). While at any kind of provided minute some depositors require their cash, the majority of do not.

8 Easy Facts About Bank Statement Described

The process includes maturation transformationconverting temporary liabilities (deposits) to lasting possessions (lendings). Financial more info here institutions pay depositors less than they get from borrowers, and that distinction make up the mass of financial institutions' revenue in most nations. Banks can match conventional down payments as a source of funding by directly borrowing in the money as well as funding markets.

Banks keep those called for gets on down payment with reserve banks, such as the U.S. Federal Reserve, the Financial Institution of Japan, and also the European Reserve Bank. Financial institutions produce money when they lend the rest of the cash depositors offer them. This cash can be used to acquire goods as well as services as well as can discover its way back into the banking system as a deposit in an additional financial institution, which after that can provide a portion of it.

The size of the multiplierthe quantity of money developed from an initial depositdepends on the quantity of cash banks should continue get (bank account). Banks also offer and reuse excess cash within the financial system and create, distribute, and trade securities. Financial institutions have several means of earning money besides stealing the distinction (or spread) in between the passion they pay on down payments as well as borrowed cash and the passion they collect from debtors or safeties they hold.

Report this wiki page